US Taxes

Operating in Delaware

We recently got this crazy bill of $42k from Delaware! Turns out we owe the state some money every year (a franchise tax), whether we’ve had any activity or not. And there are two ways to calculate this: the Authorized Shares or Par Value method.

Authorized Shares

The first calculation is based on the number of authorized shares i.e. the maximum number of shares a corporation is legally allowed to issue, as specified in its Certificate of Incorporation. A common startup practice is to authorize 10,000,000 shares (Common Stock), which makes this an incredibly expensive way to calculate franchise tax. This method is most likely what the state used in its estimate, based on a guesswork share count of 4,000,000.

Par Value

The second method a.k.a Assumed Shares is more favourable, because it considers the company’s gross assets and accounts for issued shares. For a new company like ours with no activity, gross assets comes to zero, Assumed Par Value Capital comes to zero as well, and the minimum tax applies.

Filing State Taxes

It’s pretty straightforward to pay for Delaware’s franchise tax online (see support.stripe.com). The form is kind of annoying, but with a little help from ChatGPT, we got it done. You can also recalculate the tax on this page, and it automatically uses the cheaper method.

We missed the March 1 submission deadline, so our eventual bill came to $668: $400 minimum tax, $200 for lateness, $18 interest, and a $50 filling fee.

Filing Federal Taxes

Asides state taxes, we also had to file federal taxes. The form applicable to us (a C-Corp) is called the Form 1120: the U.S. Corporation Income Tax Return. Whether or not you’ve had any activity, you’re expected to submit this too.

Filling the 1120 was more tricky. The form is quite onerous and the submission process isn’t as straightforward. Without expert knowledge on what boxes to tick, we opted to hire a professional. This cost $400 for late filling, plus a $200 service charge and $16 processing fee.

Tax Woes

In all, we paid almost $1,300 for existing as a Delaware company. We only just completed our incorporation in December (literally the end of the tax year), so this was a particularly painful cost to bear.

We could have gotten this down by filling early or exploring cheaper providers, but even then we’d have ended up paying up to $700. I think it’s just crazy how obscure the whole tax process is for new businesses and how costly professionals are.

Honestly, there should be a single box to tick that says “zero activity” and everything just gets filed. But alas, where there’s money to be made…

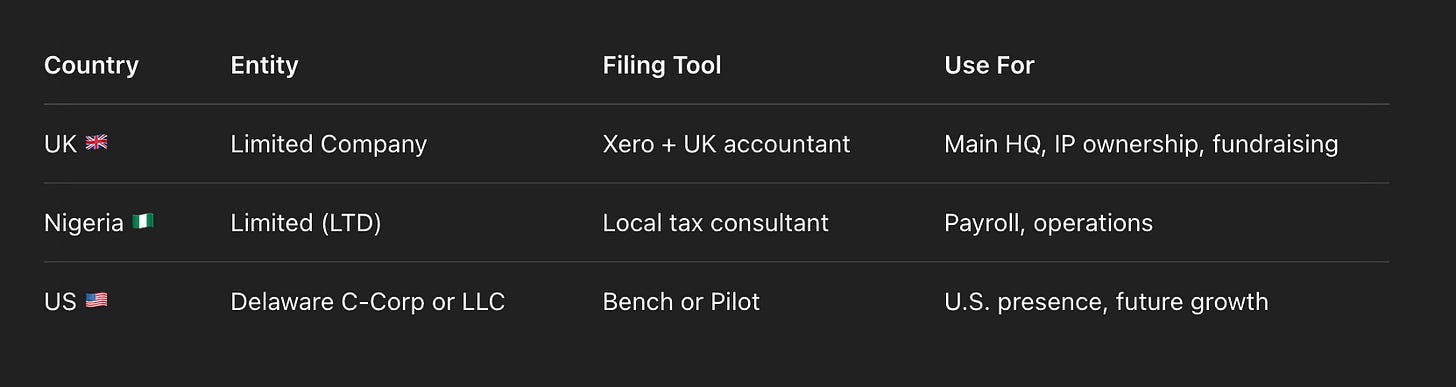

International Tax

Moonlight also operates in the UK and Nigeria, and we have tax requirements in those countries too. That’s our next priority.

Once we’re done filing this year’s taxes, my goal is to set up a simple, international tax system that runs automatically. I’ll share when we make progress.